Turning a dream career into reality is possible, but often it takes a lot of work plus a large slice of luck. You may subscribe to the view that anything worth having must be earned, but what if it comes more easily than you expected? Too easy so it’s not the prize you were after. Or too hard and not worth the effort? Is this achievable? You’re not a kid anymore, and there is a difference between dreams and ambitions, so examine yours. Dream big and aim high, but you’ve got a life to live, and the journey should be enjoyable, so don’t commit yourself to an impossibility.

There are real issues to deal with along the way, and one of the first may seem like a thankless task: paying off your student loan. What seemed like a wonderful gift a few years ago can now feel like a millstone around your neck. You need to talk to your lender about student loan refinancing. With a bit of negotiation you may be able to reduce your repayments and save thousands of dollars. Go in there with a plan, pragmatic but optimistic, demonstrating that you’ve thought your life plan through and you’re ambitious, but you’ve got what it takes. If you can sell the idea to a financial institution, maybe it is realistic after all.

Believe in Yourself

If you really do have the talent to be a megastar singer, pursue your dream career, but accept that you might have to take several detours and dead ends along the way. If you see yourself as potentially a top politician or the leader of the Western world, you’re going to have to work up a sweat and get your hands dirty. Stars and leaders have real lives and real issues too. They must pay off their loans, and they must take out further loans, which isn’t always straightforward. That’s because the world probably isn’t your biggest fan (yet) and the bank manager deals in cold, hard facts.

You’re going to have to do what is necessary, and if you’re looking at creating some financial freedom by refinancing, you may have to take steps you don’t really want to, like getting a co-signer. That is someone to take part of the responsibility for your loan, so you won’t want to let them down. This could be a good thing. There are also federal repayment programs that are designed to help people like you. You are unique in many ways, not just your ambition, but you also have workday issues to address just like everyone else.

See Your Credit Rating as an Opportunity, Not a Threat

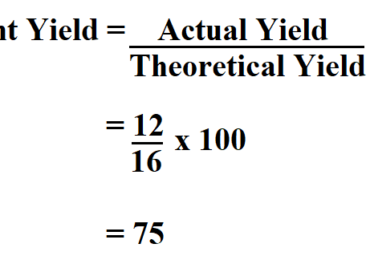

Some get into financial trouble because they think they can buck the system, but in fact, if you play the game shrewdly, the system works in your favour. You worked hard to get the most out of your college degree and now you’ve got this loan, so repay it on time and your credit score will be good. That means you can go on to bigger and better things with the blessing and help of your lender.

Read the Small Print

Understanding the terms of a business arrangement, which is what a loan is, can help avoid misunderstandings and potentially work in your favour. When do you have to begin the repayments? You may want to get going as soon as possible, or you may want to leave it to the last minute while remaining within the terms of the contract. Reading the small print can help in many aspects of life, and it’s only a few minutes of the whole timeframe, so get it done and find out exactly what you signed up for.

Many of us tend to see this detail at the bottom of the page and go “blah blah, yeah yeah”, but you could be doing yourself a disservice. Don’t let your inner Homer Simpson deal with your business affairs. He might be funny on TV, but you have real issues to deal with and you’re not going to start a new episode next week with the slate wiped clean. When you finally achieve that ambition and are up at some stage, reeling off a list of those who have helped you, it would be good to have your bank manager on it, or at least not have them at the back of the room, mumbling, “Don’t trust this person. They’re not all they seem.” So, good luck and follow that dream career, but get the mundane stuff done along the way.