Within audit, there are plenty of means to slice and dice revenue and also profit numbers. Each statistics has its very own worth to the company owner, revenue often being principal among them. Nevertheless, total income or the total amount generated before any expenditures are thought about likewise serves an essential function. Let’s take a look at Total Revenue Formula.

If you search for the last overall profits numbers, you will find them atop the earnings statement. The revenue statement introduces all profits streams over a certain period before subtracting the price of products marketed and operating costs. must know that overall income likewise goes by “gross income.” Those two terms are made use of reciprocally.

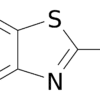

Total Revenue Formula

Nonetheless, if you are looking to determine what your overall earnings would remain in the future, the earnings declaration will undoubtedly be less practical. Possibly you’re deciding whether to use a discount rate on your service or products or whether to raise your rates. In either situation, the total profits formula will aid you to make those choices.

You can also find many online examples of calculating total revenue in The Current Cell Enter The Formula That Will Calculate The Total Revenue.

Where to Discover Total Revenue: Aim To the Income Statement

Overall income is found on the earnings statement, a settled history of how your company executed over a particular period. This can be a month, quarter, and even a year– though we recommend looking at your monetary declarations monthly.

Compared to other reports, the earnings declaration is pretty straightforward to read. Here’s a quick review of the significant sections:

Total amount Income: The first area of the income declarations shows all the cash your business brought throughout the audit period. This can be from your primary income source, as well as any other income sources. Do not forget that what you “acknowledge” as income will undoubtedly depend upon your accounting technique.

The expense of Product Sold: Additionally, referred to as COGS, this section breaks down how much it cost to create things you offered during this bookkeeping period. Anything important to the production of your item belongs below. When you deduct COGS from Earnings, you get Gross Profit.

Operating Expenses: This area includes every little thing you invested in running your organization over the accountancy period. These prices are not essential to the manufacturing of what you marketed. It consists of things like marketing costs, workplace snacks, rental fee, and so on. When you subtract Operating Costs from Gross Profit, you get Take-home pay.

Total Revenue Formula

Do you want to anticipate total profits in the future? To do so, you may check out your revenue declaration to get a baseline understanding of how much you have historically marketed. Still, you’ll be depending extra heavily on a formula rather. Right here’s how you’ll determine overall revenue for forecasting objectives.

Total Income = Amount Offered x Price.

Consequently, our artisan understands that he must cost at least 63 pairs of boots to match his overall revenue before discounting. If he believes that the discount will bring in much more orders than that, it could be a sensible move for him. This choice relies upon the business proprietor having a solid understanding of the marketplace price for boots like the ones he makes, in addition to the size of his target audience.

Why Total Income is essential to Companies

The previous instance excludes the information of just how the artisan will accomplish the boosted need for his boots– if he determines to provide the price cut. Will the production cost of each boot decrease with the raised volume? Or, will he require to employ one more bootmaker to help fulfil a need? Will it decrease production time?

There are several downstream aspects to take into consideration when rates product and services. Nonetheless, the total profits formula gives business owners an area to begin when considering their pricing.

Suppose the professional looks at that number and believes it is too reduced. In that case, she recognizes off the bat that she needs to consider increasing her rates or searching for added earnings streams that are not dependent on billable time.

On the other hand, if the total income number appears acceptable. She can begin to think about possible costs, like the software she’ll require or her tax obligations. In this instance, total earnings give her a jumping-off point to additionally discover her prices alternatives.