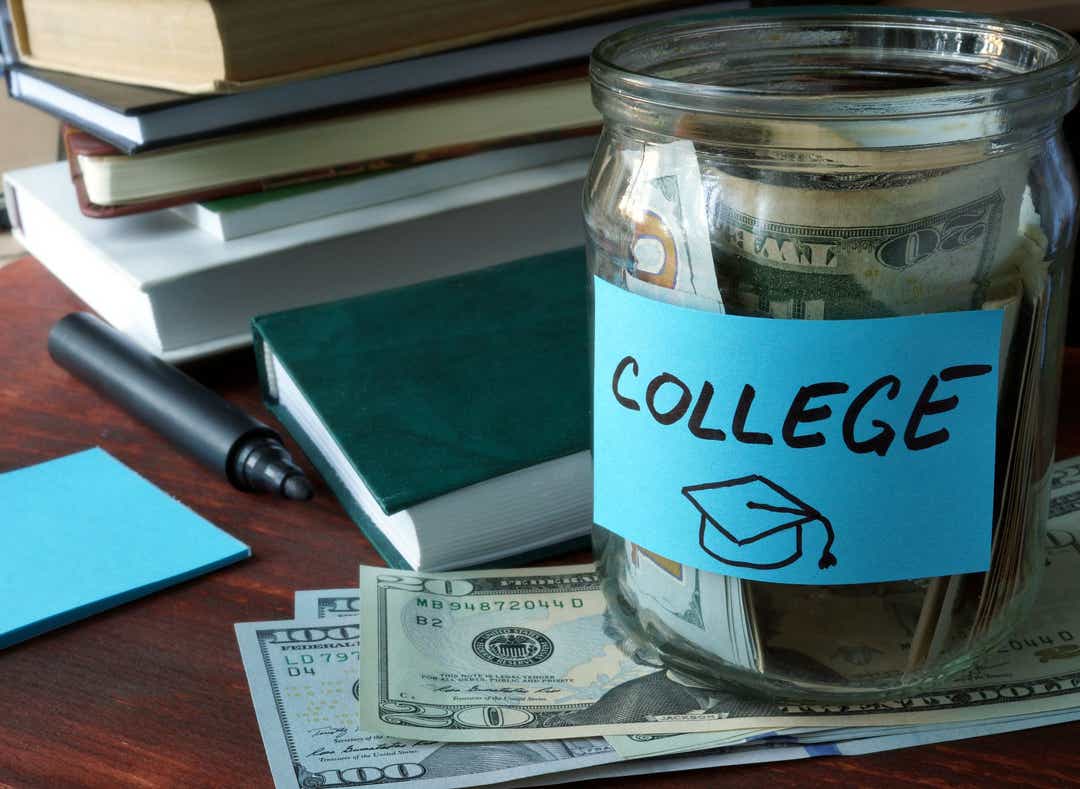

College is becoming increasingly expensive, yet many people’s income remains the same. Every family faces financial challenges when it comes to paying for the children’s college education. Yet, you can work on it, preferably early and with a clear understanding of what you’re going to face.

Buying a college education will likely be your second most expensive purchase after buying a home. On average, an in-state student pays about $10,000 a year in tuition and fees to attend a four-year public university. This is a fact taken from the College Board. Room and board aren’t included in the price, and if you attend a private institution or university out of state, the cost may be considerably higher. The cost of school isn’t something everyone can afford, which means you might have to tap into other resources to pay for your higher education.

Fret not, here are some efficient ways to fund your tuition fee in college:

1. Student Loans

Students usually use loans to pay for their educations, but it can be challenging to navigate the process effectively. There are many kinds of loans with different repayment options and stipulations.

Differences between student loans from federal agencies and those from private agencies are of primary importance. Loans from the federal government have many advantages over private ones. Here are some of them:

- There are often fixed and lower interest rates on public loans.

- The loans don’t have to be repaid until after graduation.

- Depending on your income, you have repayment options.

- With a subsidized loan, your interest will be covered by the government while you’re enrolled.

- Usually, federal loans don’t require a credit check.

It’s generally recommended that borrowers exhaust all their federal loan options before they consider private loans.

2. Crowdfunding

Crowdfunding is unique since it won’t only help you raise money for your college education; it’ll also enable friends and family members to support your goals and contribute to your success. There’s a possibility that you’ll receive support from strangers by using free platforms like givebutter.com. Aside from other causes, many students use such platforms every day to raise funds for education expenses, such as tuition, room and board, school supplies, miscellaneous, and student loan payments. The crowdfunding approach is known to provide convenience in the following ways:

- You can connect with friends, family, and coworkers through your social network.

- After you receive donations, you could already begin withdrawing your funds.

- Some platforms have no fees at all.

3. Scholarships

All levels of government, nonprofits, and even large private corporations offer scholarships, from the federal level to the local level. The number of scholarship opportunities is so vast that you might feel overwhelmed selecting which ones to apply for. No repayment is required for scholarships. The majority of scholarship programs rely on your academic record or other accomplishments to determine whether you can qualify for one.

Basically, these institutions consider your grade point average, extra-curricular activities, and scores on standardized tests as a basis for you to be awarded a scholarship. Occasionally, scholarships are awarded based on athletic achievement, but those awards are usually tied to participating in a particular sport in college.

There’s a wide range of scholarship programs, depending on who offers them and which qualifications you must meet. One-time scholarships are available, and some are renewable annually. If you have the option to renew your scholarship each year, make sure you know what you need to do to continue to receive funds.

Examine all your scholarship options to cover all or as many of your costs as possible. It’s easy to shop around for scholarships at various online sites, but it’s also convenient to look through your city, county, and state’s scholarship database. Several scholarships are awarded at the institutional level, so look into your future college or university.

4. Work-Study

You can gain invaluable experiences if you work while attending college, putting you at an advantage among your peers and classmates. The best way to gain valuable insight into your future profession and cover expenses is by taking up an internship with a salary or a job related to your career. Working while studying is one of the ways to increase your business career prospects.

Are you interested in a healthcare career? If you’re interested in gaining on-the-job experience, consider working in an emergency room as a scribe. Are you knowledgeable about STEM subjects? Apply to be a student tutor. Take advantage of paid internships to raise your income and gain an edge in your field of expertise.

As another option, you may be eligible for tuition reimbursement from your employer. As a part of their job perks, many employers now provide tuition reimbursement. To cover educational expenses, students are also able to earn money through federal work-study jobs. Graduate and undergraduate students are eligible to apply to the Federal Work-Study program.

Students who qualify for this program can work on or off-campus part-time while enrolled. Students who demonstrate financial need may be eligible for federal work-study programs. The program may not be offered in all schools. See if your desired school offers Federal Work-Study by contacting their financial aid department.

5. Grants

A scholarship is typically awarded based on merit, while a grant is determined based on financial need. Applicants for grants can apply at every level of government: federal, local, and institutional. Additionally, grants are available based on your race, gender, and demographics. Grants may also be available from organizations that provide scholarships.

Similarly, you can search for grants on scholarship websites and databases, but you can also investigate your local institutions. Inquire and ask around your community’s religious organizations whether they can provide you with grants.

The rules and deadlines for grants and scholarships differ. Some grant opportunities are renewable every year, while others are one-time offers. Consider searching for grants that consider your socioeconomic status, race and ethnicity, and your parents’ profession when you need help choosing grants. Make sure you take advantage of as many free opportunities as possible by searching for a wide variety of grants.

6. Tax Credit

Qualifying individuals can claim an Internal Revenue Service (IRS) tax credit, a tax break that can make a big difference. The past year may have been a good time to deduct qualified educational expenses, regardless of whether you’re a student, spouse, or parent.

Tuition, borrowed funds, and other expenses are all considered to be qualified educational expenses. You must also be enrolled in an eligible institution. The federal aid program serves colleges, universities, and vocational schools that participate in it. The tax credit can’t cover tuition, but it can be reimbursed to help cover the cost.

Final Thoughts

Plan your finances for college ahead of time to make the most of your post-secondary education. With the right tools, it’s possible to finish college successfully. The tips in this article will assist you in making the most of the resources in finding funds for your education.