The amount of immigrants in the US reaches 15%. This is a big audience for financial organizations, but not all banks dare to work on it. However, there are specialized financial institutions like Payday Depot and others. Let us see what they offer to immigrants.

What is needed for a bank account?

What does an immigrant need to do to open a bank account in the USA? If it is a debit account, then the person must visit the branch to be identified and present the following documents:

- a passport or a driver’s license;

- a birth certificate;

- bills that confirm the place where the person lives.

In addition, a Social Security number (SSN) is required. Only legal US residents can obtain this document. It is permission for work, it gives certain social advantages, and contains data about the income. Sometimes immigrants can use an ITIN or Alien Number instead of SSN.

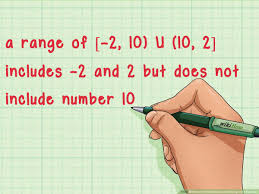

As for credit cards, here one must have a proper credit history. It is measured in points from 300 to 850 points and is collected for a long time. Only with a value of more than 700, the person can apply for credit offers.

Those who are living in the USA can easily find out their credit score in a bank branch or via special financial organizations.

As for those who are just building their credit history in the USA, some banks offer a special secured credit card product. For example, the secured credit card works as follows:

- The client deposits $300 into the account.

- The bank opens a line of credit for the same $300.

- The client has to pay 20.74% per annum for using the loan, and the service fee is $25 per year.

- After some time of using the card and as the credit score increases, the customer may qualify for an unsecured credit card.

For comparison, the rate on ordinary credit cards is zero in the first 12-15 months and then starts at 13.74% per annum.

There are other numerous options so one needs to look through them thoroughly.

Special lenders

Immigrants who use credit products in a new country for themselves are more disciplined than local residents. Often they even exceed the requirements of banks, as they do not feel very confident in unfamiliar realities.

However, in lending to immigrants, there is always a risk of social default as they lose their jobs, and hence their permanent income, much more often than citizens of the country. As for the United States, it is almost impossible for a new migrant to get a loan from a bank without having developed a credit history. He has to settle for debit, prepaid, or secured credit cards.

What if you already live in the USA but do not have all the required documents? Is there a chance for crediting? Luckily enough, yes. The market for financial organizations is steadily growing. Thus, everyone can search for a suitable option according to the conditions and requirements.